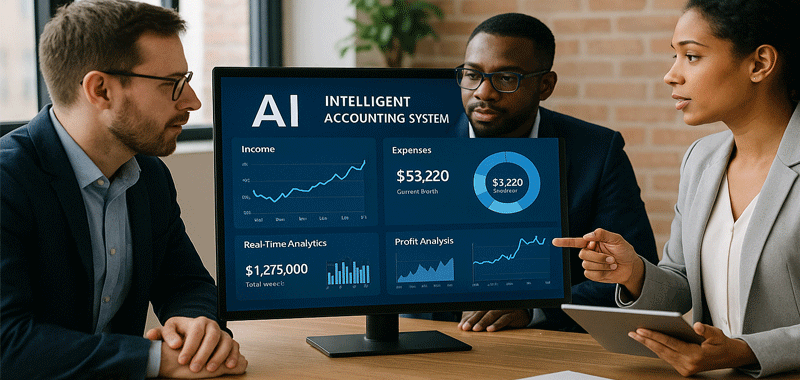

How AI Can Help in Accounting Management Software: Intelligent Accounting System Explained

Artificial Intelligence (AI) is no longer a futuristic concept—it’s a game-changer across industries. In the field of accounting, AI helps organizations move away from repetitive, error-prone manual work toward automated, data-driven, and intelligent processes. Today, AI in accounting management software is enabling companies to manage finances smarter, faster, and more efficiently. One of the standout innovations in this space is the Intelligent Accounting System developed by Intelligent Systems, a powerful platform that integrates AI seamlessly into accounting workflows.Understanding Accounting Management Software Traditional Accounting Software Challenges While traditional accounting software has been helpful in managing ledgers, payroll, and tax records, it often lacks adaptability and intelligence. Businesses face challenges such as: Manual data entry Human errors Delays in generating reports Limited predictive capabilities Why Businesses Need AI Integration AI integration bridges these gaps by introducing automation, predictive analytics, fraud detection, and real-time insights, ensuring businesses stay ahead in financial management.Role of AI in Modern Accounting Automation of Repetitive Tasks AI automates tasks like invoice processing, tax filing, and reconciliations, saving accountants hours of manual effort. AI-Powered Financial Forecasting By analyzing historical data and market trends, AI predicts future cash flows, revenue, and potential risks. Fraud Detection & Risk Management AI algorithms detect unusual patterns in financial transactions, alerting businesses about possible fraud. Smart Expense Tracking & Compliance AI ensures compliance with tax laws and regulations while providing a smart, automated way to manage expenses.Intelligent Accounting System by Intelligent Systems What Makes It Different? Unlike conventional tools, Intelligent Accounting System integrates AI at its core, providing businesses with intelligent decision-making capabilities. AI Features Integrated in Intelligent Accounting System Automated Data Entry The system eliminates repetitive data entry tasks with AI-driven automation. Predictive Financial Insights AI generates predictions about market trends, helping businesses plan ahead. Real-Time Reporting & Analytics Businesses can access real-time dashboards with up-to-date financial health. AI-Powered Decision Support The system assists in making smart business decisions based on accurate AI-driven insights.Benefits of AI-Driven Accounting Management Software Increased Efficiency & Productivity – Accountants can focus on strategic planning instead of routine tasks. Cost Reduction – Automation lowers operational costs. Data Accuracy & Transparency – AI ensures error-free data management. Improved Strategic Decision Making – With predictive analytics, businesses can make informed decisions faster.Real-World Applications of Intelligent Accounting System Small & Medium Enterprises (SMEs): Automates bookkeeping and tax compliance. Large Corporations: Helps in risk management and financial strategy. Financial Institutions: Detects fraud and ensures regulatory compliance.Future of AI in Accounting Management Software AI + Blockchain Integration A secure and transparent financial ecosystem with blockchain and AI synergy. Personalized AI Financial Advisors Future accounting systems will serve as personalized advisors for businesses.FAQs Q1. How can AI help in accounting management software? AI automates routine tasks, improves accuracy, detects fraud, and provides predictive financial insights. Q2. What is Intelligent Accounting System? It’s an AI-powered accounting management software developed by Intelligent Systems to enhance financial efficiency. Q3. Does AI reduce costs in accounting? Yes, AI reduces manual workload, minimizes errors, and cuts down operational costs. Q4. Is AI safe for financial data? AI-powered systems use encryption and fraud detection, ensuring data safety. Q5. Can SMEs use AI in accounting? Absolutely. AI tools are scalable and cost-effective for SMEs. Q6. What’s the future of AI in accounting? The future includes AI-driven advisors, blockchain integration, and real-time predictive analytics.AI is transforming the way businesses handle financial management. With tools like the Intelligent Accounting System by Intelligent Systems, companies can achieve higher efficiency, accuracy, and profitability. As AI continues to evolve, the future of accounting management looks smarter than ever.

bKash promotes ‘Gold Kinen’ to defraud people of money

TechLife ReportControversial e-commerce platform ‘Gold Kinen’ is allegedly conning people out of money in the name of selling gold online to fetch investment digitally. Mobile financial service bKash is supporting the illegal gold trading through apps.Industry insiders claim that ‘Gold Kinen’ has no stock of gold and it only runs a campaign to bag public money through lucrative offers. According to a press release issued by bKash on Tuesday, ‘Gold Kinen’ customers can now buy, store, sell, gift and collect international standard hallmarked and certified 22-karat gold bars and coins from its app through bKash payment. However, the ‘Gold Kinen’ platform has now stock of the precious yellow metal. It is allegedly defrauding people of money with lucrative offers, claimed some customers.The founders of ‘Gold Kinen’ are Kamran Sunjoy Rahman, Rafatul Bari Labib and Atef Hasan.Customers can collect their purchased gold from designated pick-up points nationwide or via home delivery within Dhaka city, according to a recent agreement between bKash and ‘Gold Kinen’.Regarding the partnership with ‘Gold Kinen’, bKash head of corporate communications Shamsuddin Haider Dalim said the MFS operator always maintains compliance to deal with a merchant or company.“We always go through papers and business models of merchant companies before making a partnership. If any company like ‘Gold Kinen’ is indulged in fraudulence, this will be investigated,” he said.The media people also contacted ‘Gold Kinen’ founder Atef Hasan for his comments. However, he neither received the call nor replied to the text message. As part of the cashback campaign till 31 May 2024, customers can get a 5 percent instant cashback up to Tk100 while purchasing gold from ‘Gold Kinen’ app through bKash payment.Industry insiders claim that the platform is defrauding people of money to fetch investment. ‘Gold Kinen’ claims it as Bangladesh’s first gold app though it has no involvement with the business of the precious yellow metal.

REVE Chat version 4.0 launched

TechLife ReportTech-enabled customer engagement solution provider REVE Chat has recently launched 'highly anticipated' version 4.0 merging instant messaging with live chat functionalities to transform service from website.This will now enable enterprises to initiate and complete more chats directly on websites and the approach not only enhances engagement but also drives higher conversion rates and lowers digital promotional costs, says a press release.REVE Chat Version 4.0 introduces several key features aimed at improving user experience and agent productivity. The new Live Chat Widget with Chat History allows seamless access to past conversations, providing an intuitive and familiar interface akin to popular messaging platforms.REVE Chat CEO M Rezaul Hasan said that connectivity of instant messaging and live chat in 4.0 version represents a significant advancement in customer engagement Platform.'The positive feedback from our users inspires us to continually innovate and explore new avenues,' he siad.REVE Chat has already been trusted by leading brands worldwide including Commercial Bank of Kuwait, Kuwait; Bank of Scotia, Colombia; The National Institute of Transparency of Mexican Government, the Worlds one of the largest network equipment-making companies - Legrand, France, PublicGold, Malaysia; Canadian Hearing Institute, Canada; leading EdTech company - iNeuron, India, and many more.Some of the leading brands in Bangladesh such as bKash, 10 Minutes School, Guardian Life Insurance, Southeast Bank, Othoba.com, LankaBangla Finance, Butterfly Group, Pickaboo.com, and Transcom Digital are successfully using REVE Chat to engage with their customers.

Send money to the wrong account? Here's how you can get money back!

A lot of the time money inadvertently goes to the wrong number in financial transactions in development. This mistake is made by making financial transactions from one place to another quickly through mobile number. Many people lose money due to this problem. So let's know what to do to get the money back if such a mistake is made.Don't call the recipient immediately if the money goes to the wrong number at first. Because when money goes to another number by mistake, very few people have the mentality to return it. So if he withdraws the money, the victim will have nothing to do.For that, if money is accidentally sent to any number from the account, it is wise to first go to the nearest police station and make a GD with the transaction number and contact the bKash / Rocket / Cash office with the GD copy as soon as possible.Because as soon as the complaint is made, the officials of the institutions check the GD copy and the message.After that, when the money is forgotten, the account of that person is temporarily locked. So that he cannot raise any money.Immediately after that, the concerned officials tried to contact the person on the phone. If the recipient confirms the truth of the incident over the phone and says that the money is not his, then Bikash transfers the money from the office to the specific person.And if the person claims to have his own money, then the authorities instruct him to come to the office with the proof within 7 working days and fix the account. If the person does not come within the next 6 months without following the instructions, the money will reach the account of the victim sender. If it does not come in the next 6 months, the account will be auto disabled forever.

PM's grant to Qawmi Madrasa in e-check

Honorable Prime Minister Sheikh Hasina has provided financial assistance of Taka 8 crore 31 lakh 25 thousand to 6,959 Qawmi Madrasas of the country through Electronic Funds Transfer (EFT).It has been informed that it has been sent to the concerned authorities from the Prime Minister's Office on the occasion of Holy Ramadan. Of these, 1,780 madrasas in Dhaka division, 1,481 in Chittagong division, 704 in Rajshahi division, 1,011 in Khulna division, 402 in Barisal division, 481 in Sylhet division, 703 in Rangpur division and 397 in Mymensingh division have been provided with the assistance, the source said.

The transaction cost per thousand is 6 Taka, in Nagad

Bangladesh Post Department's digital financial transaction "Nagad" has reduced the transaction costs of small and medium traders by 6 taka in the face of the epidemic cervical virus. That is why "Nagad" brings 'Independent Merchant's service.Under this service, a " Nagad " "independent merchant" trader can now make payments to another " Nagad " "independent merchant" as payment for the merchandise required, at a cost of only 6 taka per thousand from now.All the individuals of Bangladesh will profit in a roundabout way by decreasing the exchange expenses of little and medium brokers. This " Nagad " activity will positively affect individuals' lives. The Mobile Financial Service (MFS) thinks " Nagad " implies that individuals will endure if small business survive. Hence, at this crucial point in time in the express, the state administration " Nagad " plans to remain by five kinds of organizations and merchants.These incorporate pharmacy, pharmaceuticals, staple goods, post workplaces, markets, and little and medium brokers. Likewise, under the heading of Hon'ble Minister Mostafa Jabbar, chats with portable administrators from the earliest starting point of the lockdown in the nation have chosen to purchase computerized cash for versatile top-up retailers the nation over.As a result, retailers like Robi, Banglalink and Teletalk can buy digital top-ups on mobile at any time through " Nagad ". As a result, people are enjoying continuous service in this disaster due to " Nagad ".Besides, " Nagad " is using that money to reduce transaction costs by reducing its advertising budget to stand beside the common man in such a crisis. Apart from this, initiatives have been taken not to charge the first 1000 taka cash out of Nagad and to reduce the settlement charges for essential commodities and medicines.Workers of " Nagad " distribute food and necessities free of cost to the underprivileged people in 492 Upazilas of the country under the care of the state-owned postal department. " Nagad " believes, "If people live, the country will survive".